Moving Average Indicator

Over the years, hundreds of indicators have been created in technical analysis. However, moving averages are considered one of the most reliable, objective, and useful tools. This is a very popular and relatively simple indicator among EO Broker users.

In this EO Broker tutorial, we’ll explain why moving averages are so important, how they are calculated, and how to use them as a part of your trading strategies, even with EO Broker Mobile Trading.

Different forms of moving averages

Moving averages can take a variety of forms. Identifiable as lagging indicators, they have one purpose — to determine the current trend of financial assets by smoothing fluctuations and noise. By assessing the direction of a trend, traders can make these trends work in their favor and increase the number of winning trades.

The moving average is the result of averaging the security price over the selected period (N). Once calculated, the final value is plotted on the chart as a curved line so that traders can view the smoothed data rather than focusing on daily price movements. In addition, multiple moving averages can be plotted by adjusting the number of periods used in the calculation.

The simplest form of this indicator, known as a simple moving average (SMA), is calculated by finding the arithmetic mean of a given set of values. This kind of indicator is available on the EO Broker platform. For example, to calculate a simple 10-day moving average, take the sum of the closing prices for the last 10 days and then divide by 10. If a trader wants to plot a 50-day moving average, the same type of calculation will be performed, but will accordingly include prices for the last 50 days.

The simple moving average is extremely popular with traders, but like all technical indicators, it has its drawbacks. Many argue that the usefulness of SMA is limited because every point in a data series has the same weight, no matter where it occurs in the sequence.

It is believed that the latest data is more significant for the valuation of an asset than older data, and should have a greater impact on the final result. Thus, to give more weight to the new data, an exponential moving average (EMA) was created.

Setting up moving averages

Moving averages are fully customizable, which means the user can freely choose any time frame. The shorter the time interval, the more sensitive the moving average is to price changes, and vice versa. There is no “correct” time frame when setting up moving averages. The best way to figure out which one works best for you is to experiment with several different time frames until you find one that suits your EOBroker strategy.

Some of the main functions of a moving average are identifying the direction of a trend, and identifying potential areas where an asset will find support or resistance. In addition, moving averages can be useful when placing stop-loss orders.

Trend

Determining the trend is one of the key functions of moving averages. Moving averages are lagging indicators, which means that they do not show a trend reversal, but confirm the existing one. As you can see in the EOBroker review chart, stocks are in an uptrend when the price is above the moving average and the moving average is pointing up. Conversely, a price below the downward moving average confirms a downtrend.

Support

Another common use of moving averages is to identify potential price supports. The fall in price is often slowed down when the moving average passes. In addition, a rebound is possible from key moving averages, for example, with periods of 50 or 200 days, but this requires confirmation of different technical indicators we will describe in other articles.

Resistance

When the price of an asset is below the moving average, it can be difficult to gain a foothold above it. Thus, MA becomes resistant and is used by traders as a sign of profit-taking. Also, in this case, moving averages can be considered as entry points to a short position, since the price often bounces down from this line and continues to decline.

Stop loss

The support and resistance characteristics of moving averages make them an excellent risk management tool. The ability of moving averages to identify strategic stop-loss locations allows traders to close losing positions on time. Traders who have entered a long position set a stop loss below the moving averages.

Intersection of price and moving average

The main principle of the analysis of this trend indicator is to consider the position of the price chart relative to the midline. During the period when the price is above the average, the current situation is better than expected, which means that bullish sentiments prevail in the market. Conversely, if the price falls below the moving average line, this is a signal that market expectations have not been met and bears dominate the market. Thus, the intersection of MA with the price can become a signal to make a deal: the crossing of the price from bottom to top gives a signal to buy, from top to bottom — to sell.

However, there is an important point to consider here. Moving averages are a trend indicator that gives good signals to open and close positions only if there is a strong trend. When the market is in a long flat, these signals are false and lead to losing trades.

Moving average crossover

If the market is showing strong volatility, then the intersection of two or more moving averages with different periods is more suitable for analysis. The principle of receiving a trading cue from the intersection of two averages is similar to the principle of crossing the moving average with the price chart, with the only difference that instead of the price chart, in this case, the second moving average with a smaller N parameter appears.

Thus, a signal to buy will be the crossing of a slow-moving average, that is, with a large N, from the bottom up by a fast-moving average, and a sell signal will be a crossing from top to bottom.

And in this case, do not forget that the price must be in a trend.

It’s also worth noting that when opening with a gap up or down, moving averages can give false buy or sell signals, as they are lagging indicators.

Also, moving averages should be combined with other indicators and oscillators, such as the MACD-Histogram or RSI Oscillator, which will confirm the moving signals. We will talk about them in detail in the following reviews. It is also useful to use volumetric confirmation of the strength of the trend.

Using moving averages on EO Broker

Now let’s explain how to use EO Broker and earn money with the moving average indicator.

Even EO Broker beginners can try using the moving average indicator to start earning with EO Broker — just follow these easy steps:

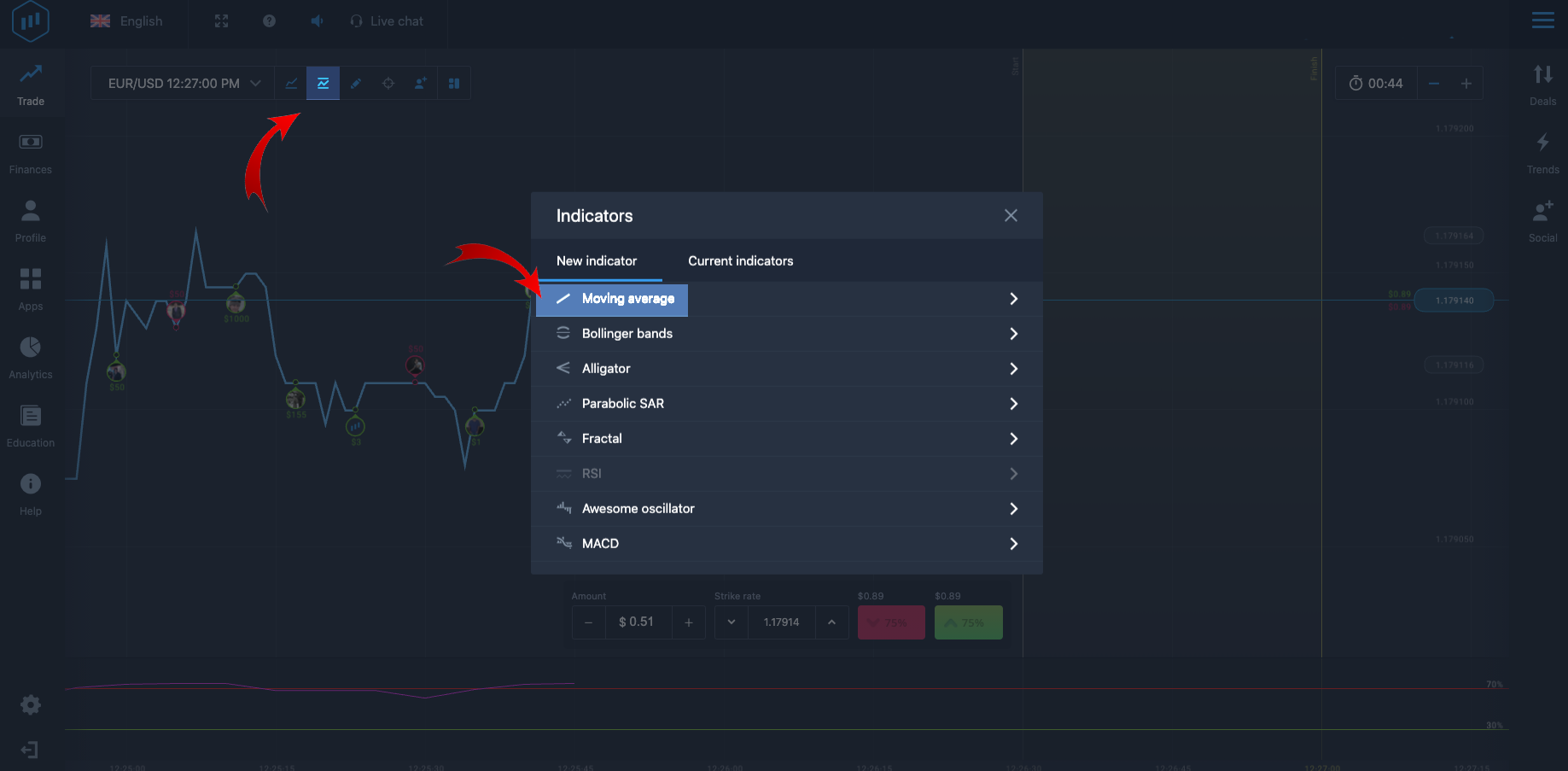

- Click on the “Indicators” icon from the menu.

- Select the “Moving average” indicator.

- Confirm and save settings.

- If the moving average line shows a downtrend, press the red button and wait for the result.

- If your projection is correct the profits will be added to your account.

- If the moving average line shows an uptrend, press the green button and wait for the result.

- If your projection is correct the profits will be added to your account.